Once you've selected the products you would like to order, simply add them to your shopping cart.

How it Works

-

-

2. Choose Affirm

Choose Affirm as your payment option at checkout, provide your shipping details, enter your personal information and get a real-time decision.

-

3. Choose a Payment Plan

Select a payment plan that works best for you and your project.

FAQ's

What is Affirm?

Affirm is a financing alternative to credit cards and other credit payment products. Affirm offers realtime decisions and financing for purchases online. With Affirm, you can buy and receive your purchase now, and pay for it in fixed installments over time.

How does Affirm work?

Here are the steps in the Affirm loan application process: Select to pay with Affirm at checkout. Affirm will prompt you to enter a few pieces of information – your name, email, mobile phone number, date of birth, and the last four digits of your social security number. Please ensure that all of this information is your own and is consistent information otherwise you may experience difficulty with your checkout. To ensure that you’re the person making the purchase, Affirm will send a text message to your cell phone with a unique authorization code. Enter the authorization code into the application form. Within a few seconds, Affirm will notify you of the loan amount you’re approved for, the interest rate, and the number of months you will have to pay off your loan. Rates range from 0-36% APR and payment options include 4 interest free payments every two weeks or monthly payments with 3,6,12,18,24 months term length. Eligibility is based on creditworthiness. Affirm will also state the amount of your fixed, monthly payments and the total amount of interest you’ll pay over the course of the loan. If you would like to accept Affirm’s financing offer, click “Confirm Loan” and you’re done. Going forward, you’ll get monthly email and SMS reminders about your upcoming payments. You can also set up autopay to avoid missing a payment. Your first monthly payment will be due 30 days from the date we the merchant completes processing your order.

How does Affirm approve borrowers for loans?

Affirm will ask you for a few pieces of personal information – your name, email, mobile phone number, date of birth, and the last four digits of your social security number. Affirm uses this information to verify your identity, and to make q quick loan decision. Affirm will base its loan decision not only on your credit score, but also on several other data points about you. This means you may be able to obtain financing from Affirm even if you don’t have an extensive credit history.

What are Affirm’s fees?

Affirm loans vary between 0-36% APR simple interest (0% APR is offered at select merchants). The corresponding finance charge is the only fee associated with an Affirm loan - Affirm don’t charge late fees, service fees, prepayment fees, or any other hidden fees. Affirm strive always to be more transparent and fair than any other form of financing.

How is interest on an Affirm loan calculated?

Affirm calculates the annual percentage rate (APR) of a loan using simple interest, which equals the rate multiplied by the loan amount and by the number of months the loan is outstanding. This is different from compound interest, in which the interest expense is calculated on the loan amount and also the accumulated interest on the loan from previous periods. You can think about compound interest as “interest on interest,” which can make the your loan amount grow larger and larger. Credit cards, for example, use compound interest to calculate the interest expense on outstanding credit card debt.

How do I make my payments?

Before each payment is due, Affirm will send you reminders via email and SMS that will include the installment amount that is coming due and the due date. You can also sign up for autopay so you don’t risk missing a payment. Please follow these steps to make a payment: Go to affirm.com/account You will be prompted to enter in your mobile number where you will be sent a personalized security pin. Enter this security pin into the form on the next page and click “Sign In.” You’ll now see a list of your loans and payments coming due. Click on the loan payment you would like to make. You can make a payment utilizing a debit card or ACH bank transfer.

How long does it take to get my money back in the event of a return?

You should see a refund from Affirm post within 3 to 10 business days, depending on your bank’s processing time.

How do refunds work on items I return?

A refund will post to your Affirm account if we process your refund request. In the event that we issue you store credit instead of a refund, you will still be responsible for paying off your Affirm loan. If you have already made loan payments or a down-payment, Affirm will issue you a refund credit to the bank account or debit card that you used to make the payments. You should see a refund credit within 3 to 10 business days, depending on your bank’s processing time.

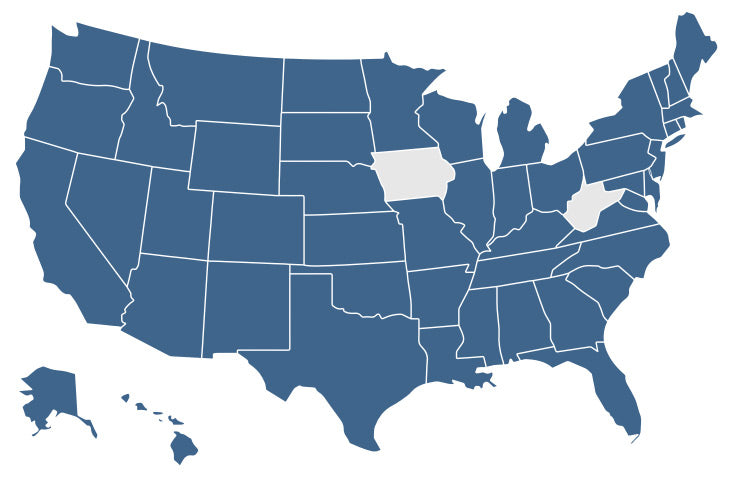

US Resident

*Terms and Conditions may apply - https://www.affirm.com/terms

Items over $50 USD

Questions

Check out the Affirm website, or Affirm FAQs above, or connect with one of our customer consultants, toll free at 1-877-717-5811 or via email at customerservice@builddirect.com

*Rates from 0–36% APR. Payment options through Affirm are subject to an eligibility check and are provided by these lending partners: affirm.com/lenders. Options depend on your purchase amount, and a down payment may be required. CA residents: Loans by Affirm Loan Services, LLC are made or arranged pursuant to a California Finance Lenders Law license. For licenses and disclosures, see affirm.com/licenses.